Top Features and Benefits of Personal Loan

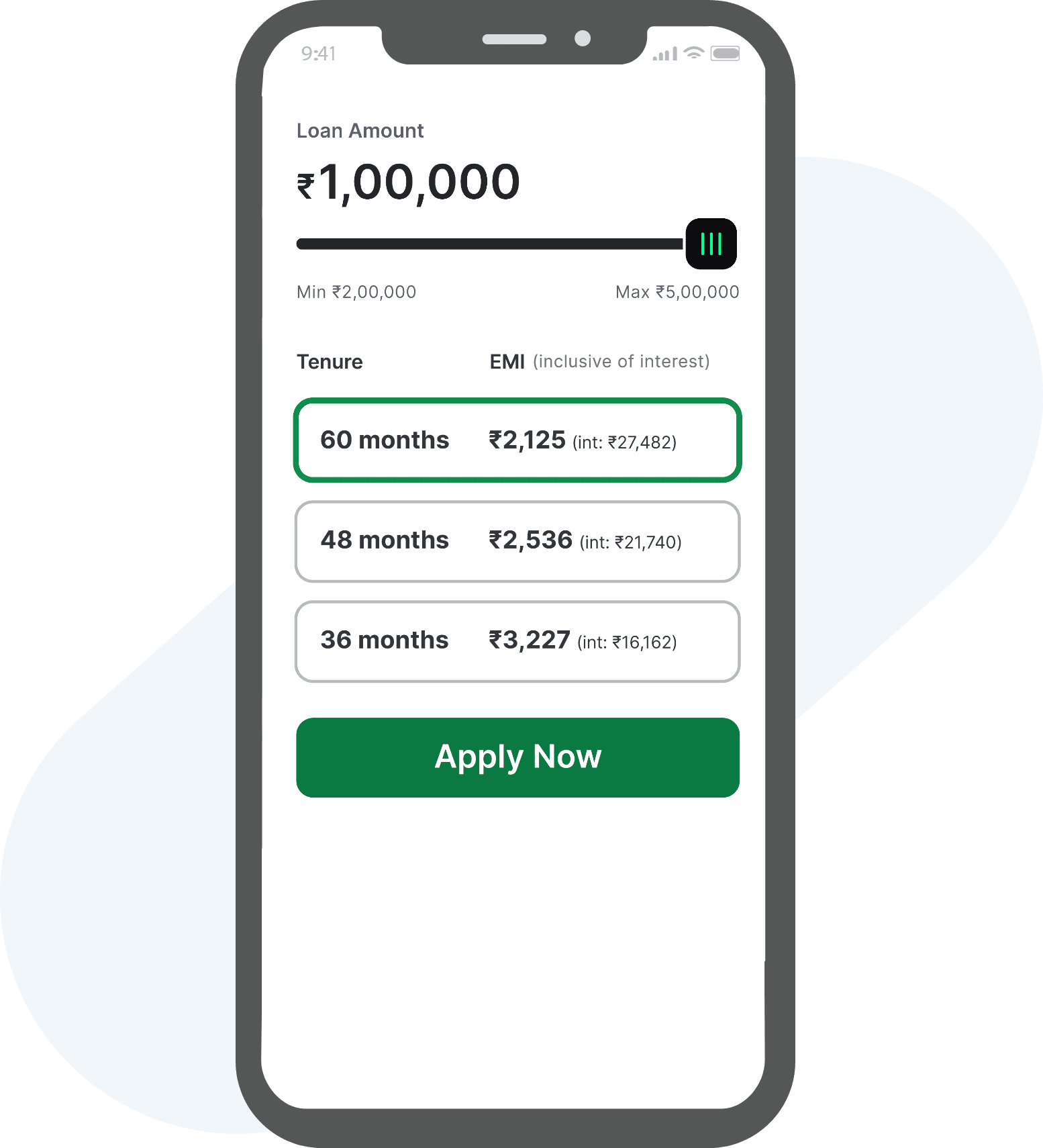

Flexible Loan Amount

Choose any loan amount starting from Rs. 50,000 upto Rs. 25 lakhs.

24 Hour Disbursal

Once approved, your loan amount will be credited to your account within 24 hours.

Collateral Free Loans

To apply for a personal loan through MoneyGray, you don’t have to pledge any asset or arrange for a guarantor

Affordable Interest Rates

We understand how important interest rates are as they determine the EMI amount to be paid. At MoneyGray, the interest rate starts at just 0.75% per month