Home Renovation Loan

Your home is a representation of amenities and comfort that you have built for your family for many years. The home is not just a place to live, it is an accumulation of memories, joy, and familiarity. It should be your utmost priority to maintain your home structure for better living.For that purpose, you need a MoneyGray personal loan for home renovation to transform your existing home into a better place.

A personal loan for home renovation helps you get funds for home repairs and renovations of an existing house. The loan helps by providing funds for any expense, like painting, flooring, Enter your phone number to get started Get OTP Apply for Personal Loan Online Enter your mobile number I authorize MoneyGray to verify my PAN, mobile no., contact via call/SMS/Email & access my credit report. I agree to the terms of the User Consent Form, Privacy Policy & Terms and Conditions.Phone No. * Home Personal Loan Service Request Blog Contact Us Login Instant Personal Loan MW First Program waterproofing, sanitary work, etc. You can avail a completely digital home renovation loan of upto ₹ 25,00,000 at affordable interest rates. The process requires minimal documentation and have flexible loan terms.

Features and Benefits of Personal Loan for Home Renovation

Get the best interest rates on home renovation loans starting at 9% p.a

Instant personal loans with a 100% digital, and transparent loan approval process.

You can get personal loans with a flexible repayment tenure ranging from 12 to 84 months

Claim a deduction of upto INR 30000 per annum against the interest paid on home renovation loans.

Eligibility Criteria for House Renovation Loan

-

All salaried professionals working at a private sector company or public undertaking

-

The age of the borrower at the time of filing for a loan must be between 18 to 55 years.

-

A customer with a minimum credit score of 650 can apply for a personal loan for home renovation at MoneyGray

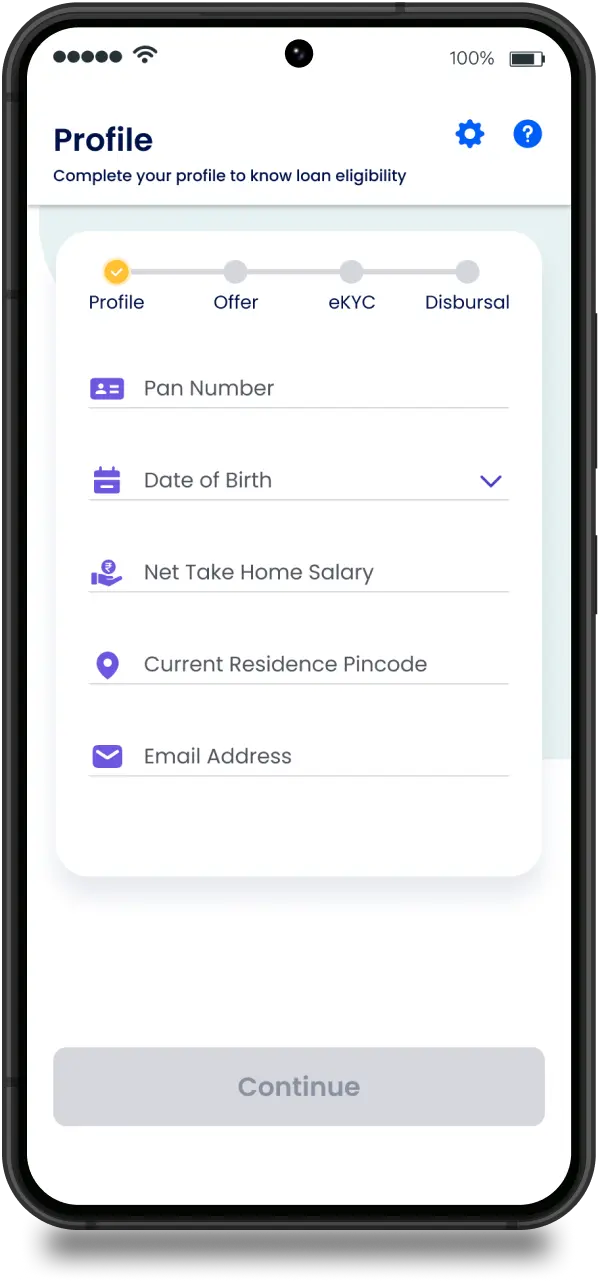

How to Get Marriage Loan from MoneyGray?

Step 1

Visit MoneyGray or download the app

Step 2

Fill the application form online

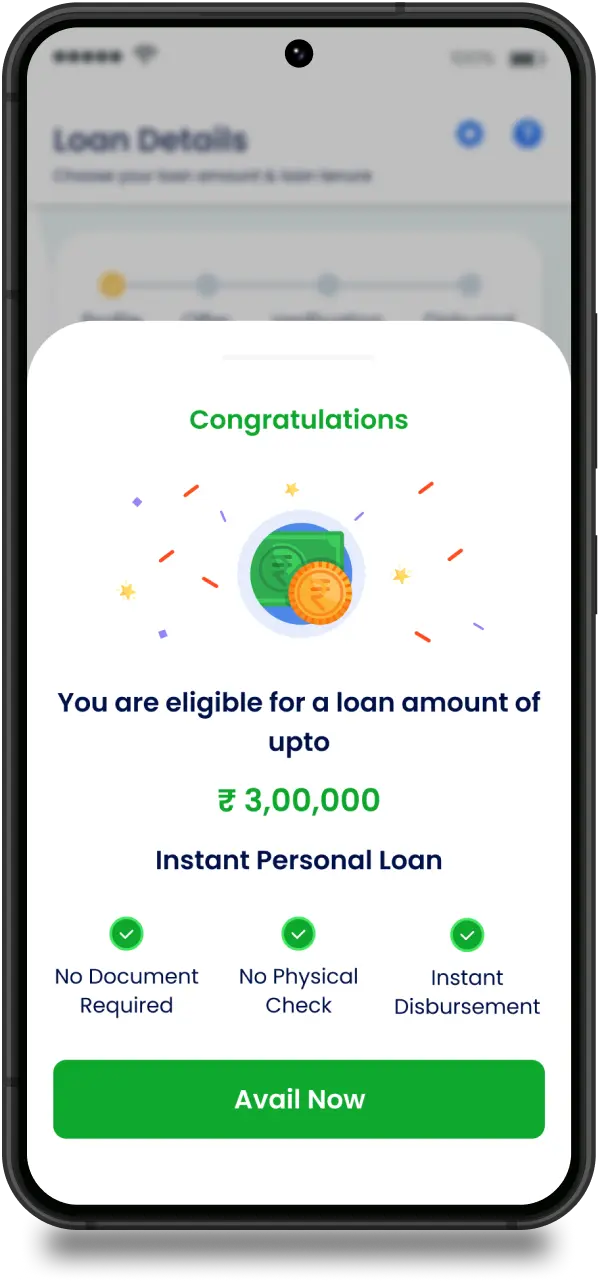

Step 3

Get Quick Approval

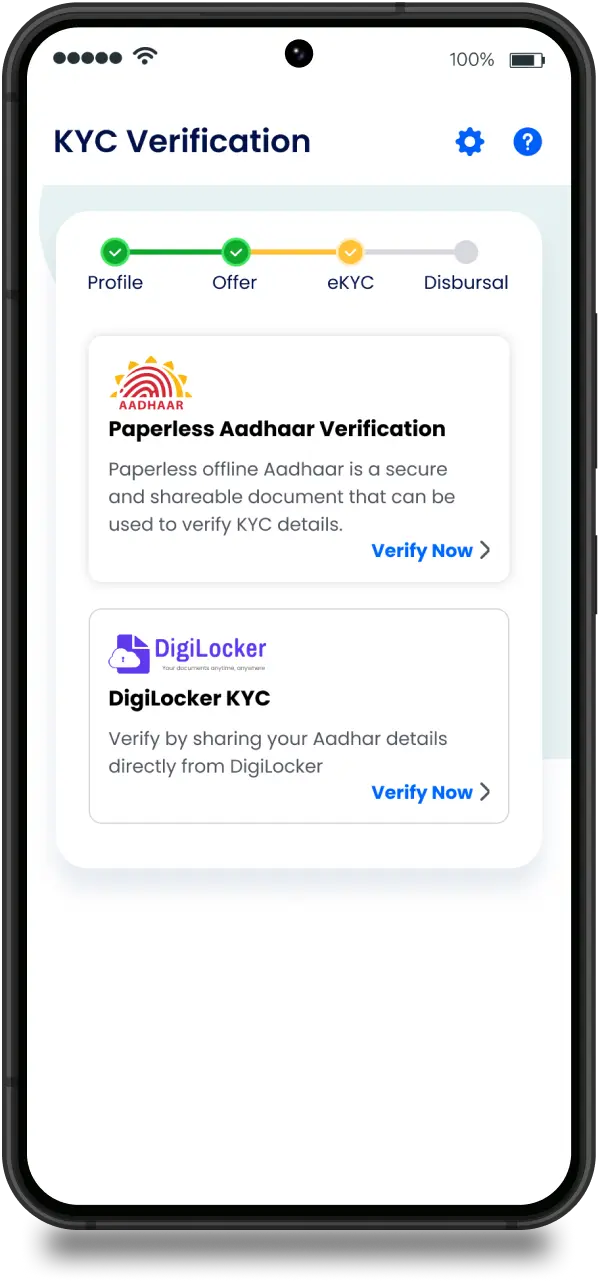

Step 4

Complete e-KYC and verification

Step 5

Get funds in your account

Frequently Asked Questions

What is a personal loan for home renovation?

A personal loan for home renovation provides instant funds to help you deal with any expense while renovating your existing property. A home renovation loan covers expenses like labor,material, asset and purchasing cost, etc.

Why should you choose a home improvement/renovation loan?

There are a number of reasons to choose a home renovation loan.

- Home renovation is an expensive affair. Therefore, it is important to have the necessary funds in your account

- MoneyGray home loans come with flexible loan terms and provide you with instant funds.

- Interest rates for home renovation loans are comparatively lower than other personal loans. Hence, reducing the overall cost of the loan.

How long does it take to get a home improvement loan?

MoneyGray home renovation loan process takes 30 seconds for in-principal approval.Customers with loan approvals get instant money in their bank accounts within the same day.

How to afford a home renovation?

Home renovation loans are collateral-free loans and are based on multiple factors. These factors include your credit score, employment history, and the income of the borrower. Therefore, a customer must be cautious about their credit history.

What is a home improvement loan called?

Personal loans are unsecured credit provided based on the credit history and credit score of the borrower. Home improvement loans are a part of personal loans, therefore, are called Personal loans are unsecured credit provided based on the credit history and credit score of the borrower. Home improvement loans are a part of personal loans, therefore, are called