Personal Loan Interest Rates - Related FAQs

1. What Are The Different Ways To Apply For A Loan At MoneyGray?

Ans: Instant and Paperless Personal Loans from MoneyGray are very easy to apply. You wouldn’t need to visit a branch of a bank or any financial institution to apply for our loan. You can easily apply for our loan on our website or download the loan app in four simple steps.

2. What Are The Basic Requirements To Get Your Personal Loan Application Approved?

Ans:

The eligibility criteria to get a personal loan from MoneyGray is simple as given below -

Be a salaried individual

Monthly in-hand income of ₹13,500 or more for salaried applicants and ₹15,000 or more for self-employed applicants

Income should be credited directly to the applicant’s bank account

Minimum CIBIL score of 600 or Experian score of 650

Should be aged between 18 years and 55 years

3. What Are The Income And Credit Score Requirements To Avail A Personal Loan From MoneyGray?

Ans: Given below are the income and credit score requirements that need to be fulfilled by applicants

| Income and Credit Score Eligibility Criteria |

|

Minimum In-Hand Income |

Area of Residence |

CIBIL Credit Score Requirement |

| Salaried Individuals |

Rs 13,500 |

Any |

CIBIL Score of 600 /Experian Score of 650 and above |

| Rs 20000 |

Mumbai/Thane or the NCR region (Delhi, Noida, Gurgaon, Ghaziabad, Faridabad, etc.) |

New to Credit or CIBIL Score of 600 /Experian Score of 650 and above |

|

| Rs 15000 |

Metro City other than Mumbai and NCR |

CIBIL Score of 600 /Experian Score of 650 and above |

4. Do I Need To Provide Any Security Or Collateral Or Guarantors?

Ans: Instant and online personal loans from MoneyGray don't require security, collateral, or guarantors of any kind.

5. What Is The Minimum And Maximum Loan Amount That Is Provided?

Ans: Based on your eligibility, you can avail a loan of any amount between Rs. 5,000 and Rs.25,00,000

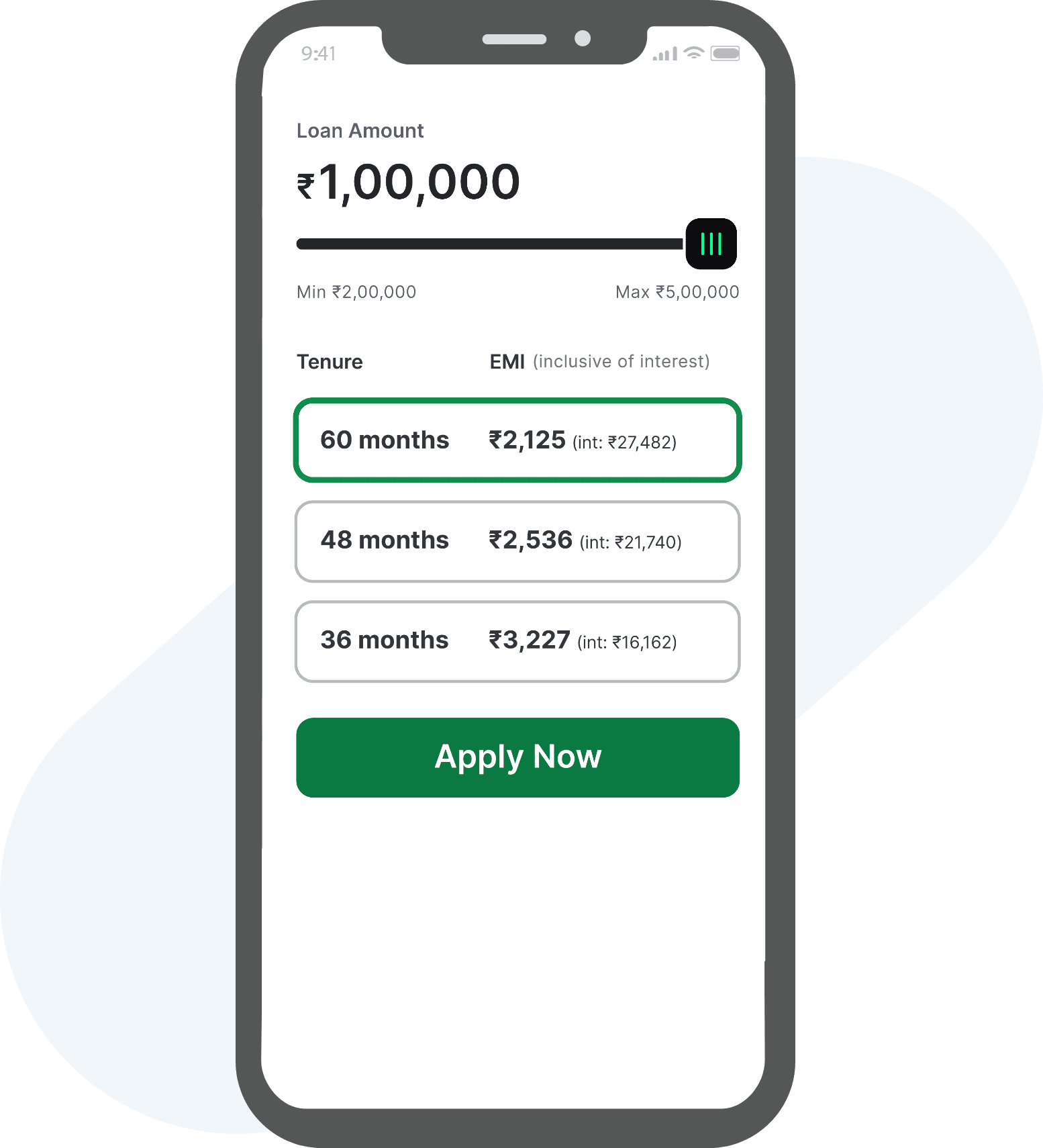

6. What Are The Repayment Tenure Options?

Ans: MoneyGray allows you to take control of your repayment schedule, so you can choose any tenure up to 60 months based on your eligibility and loan amount availed.

7. How Much Time Does It Take For The Instant Loan To Be Disbursed?

Ans: We try our best to process your loan within a time frame of 24 business hours. However, this does not include the time taken for eligibility check, loan application, and submission of the NACH mandate.

8. Do You Give Loans To Self-Employed Individuals?

Ans: Yes, we do provide loans to self-employed applicants as long as they meet the minimum income and eligibility requirements.

9. Will I Get A Loan If I Get My Salary In Cash?

Ans: Currently we only provide loans to those individuals who receive their salary via bank transfer – directly from their employer. We will not be able to give loans to applicants who get their salaries in cash.

10. Can I Cancel The Loan At Any Stage?

Ans: A personal loan application can be canceled only before the submission of the Loan Agreement Form. Once that is submitted, you will not be in a position to cancel the loan. Please check here to know about cancellation charges levied by us.

11. How Can I Calculate EMI For A Personal Loan?

Ans: The EMI amount that you will need to pay is based on the loan amount chosen, rate of interest imposed, and repayment tenure chosen. When applying for a MoneyGray instant personal loan, we will calculate the EMI for you based on the information provided by you. Additionally, you can also check out our simple EMI calculator to find out how much EMI you may have to pay.

12. How Do I Repay The Loan?

Ans: Loan is repaid in EMIs which is a combination of your principal and interest amount. This amount is auto-debited from your bank account on the 5th of every month so applicants will have to maintain sufficient balance in their account on the due date. This is done only after you’ve authorized us to deduct the proposed EMI amount that’s specified during the loan request process.

13. What Happens If I’m Not Able To Pay My EMI On Time?

Ans: The loan amount gets automatically debited on the 5th of every month. If you don’t have the required funds in your account, we allow a grace period of up to 3 days during which you can request a Loan EMI transfer through the app to avoid any late charges. Beyond this time period, a late payment fee will be charged.

If you’re still unable to pay the EMI on time after the grace period, you will have to pay cheque bounce charges and a separate late payment fee – Rs.500 (cheque bounce charges) + Rs.10/day (late payment fee). This fee will add up until you make the payment for that month.

14. Can I Make A Manual Payment Of The EMI?

Ans: Yes. If the auto-debit facility is not activated for your linked account, you can pay the EMI loan manually through the ‘Pay Now’ button on our app

15. Can I Make Part Payments Of The Loan Amount?

Ans: We don’t allow part-payments for the loan. However, we do allow applicants to foreclose their loan after a minimum number of EMIs have been made as given below -

| Fees & Charges |

Amount to be Paid |

| Interest Rate |

Starting from 0.75% per month |

| Loan Processing Charges |

Starts at 2% of the approved loan amount |

| Part/Full Payment of the Loan (Loan Foreclosure) |

- No part payments are allowed

- Foreclosure allowed after a minimum of 3 EMIs.

|

| Interest on Overdue EMIs |

2% per month on the overdue EMI/Principal loan amount |

| Cheque Bounce |

Rs.500/- for every bounce |

| Loan Cancellation |

- No additional charges will be levied apart from the interest amount for the period between loan disbursement and loan cancellation.

- Processing fees will also be retained

|

16. What Should I Do If I’m Willing To Pay Off The Entire Loan Amount In One Go?

Ans: If you have already paid a minimum of EMIs based on your loan repayment term, you can pay opt for loan foreclosure. Please call 9163289249 or send an email to payments@moneygray.com. We will assist you in making the repayment

17. Why Can’t I See The Loans Section On My MoneyGray App Whereas My Friends Can See Such A Section On Theirs?

Ans: You might be using an older version of the MoneyGray App, please update it to see the loans section on your App.

18. What Happens If The App Crashes When I’m Midway Through My Loan Application Process?

Ans: We have taken all necessary measures to ensure that our app is smooth and bug-free. However, if it still crashes for some reason you will be able to restart the application process from the same step.

19. Does My Loan Request Data Get Shared With The Lender When I Apply For A Loan?

Ans: Yes, your loan request data will get shared with the lender. This is done to facilitate the process of you getting a loan from the lender.

20. Who Do I Get In Touch With If I Have Any Queries Or Feedback To Give?

Ans: We would love to hear from you. If you have any queries or feedback please contact us at Email: customercare@moneygray.com

21. What Should I Do If I No Longer Want To See Any More Loan Offers From MoneyGray?

Ans: If you are sure you want to miss out on all the exciting personal loan offers from us please mail us at lcustomercare@moneygray.com and we will take your name off the mailing list.