How to Get Instant Personal Loan on Aadhaar Card

A personal loan on Aadhaar Card is an unsecured credit provided by lending institutions to handle unforeseen situations that demand instant financial assistance. At MoneyGray, you can get a quick aadhaar-based personal loan of upto INR ₹ 25,00,000 at affordable rates with multiple facilities that facilitate instant access to funds in times of need.

An aadhaar card is a 12-digit distinct number that stores your biometric data and is used as an individual's address, ID, and age proof. Instead of carrying out a document-intensive

process to validate your identity, lenders use an aadhaar card as a single KYC document which expedites the verification process and results in quick approval on loan applications.

Features and Benefits of Aadhaar Card Loan

Digital identity verification via v-KYC.

Affordable rates starting @ 9% p.a.

Post approval, get same-day disbursal of funds.

Flexibility to manage repayments online.

Eligibility Criteria

-

Age: A candidate must be aged between 18 to 55 years

-

Net monthly income: INR 13,500

-

Credit Score: Minimum credit score requirement is 650

-

Total Work experience: Minimum 2 years

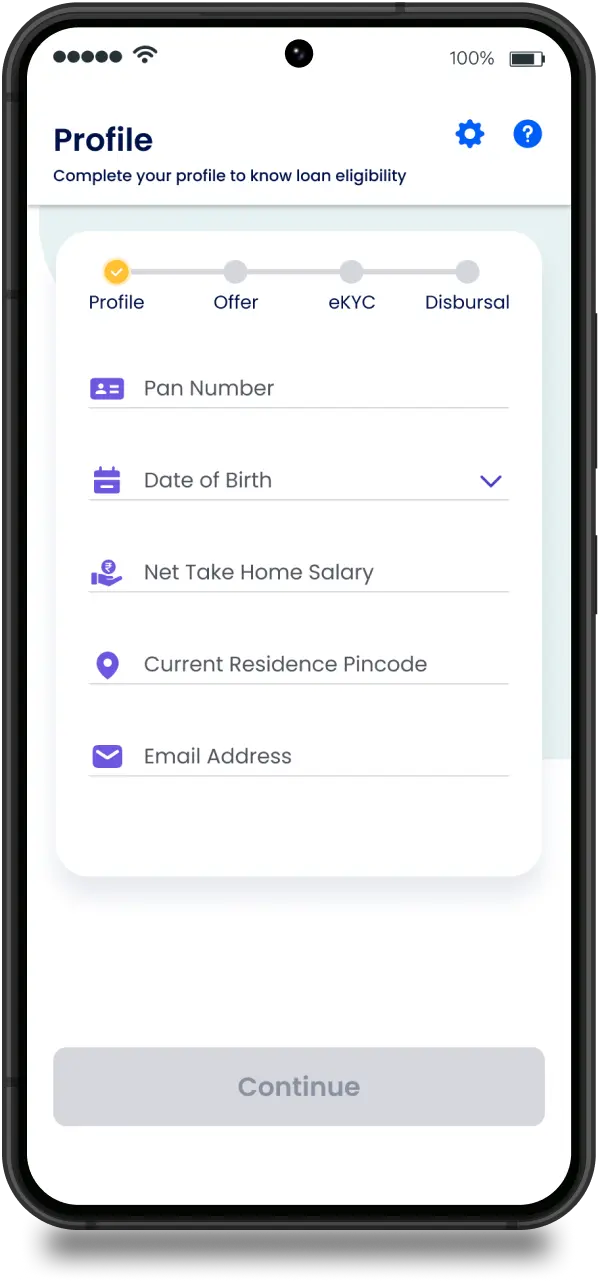

How to Apply for Aadhaar Card Loan?

Step 1

Visit MoneyGray or download the app

Step 2

Fill the application form online

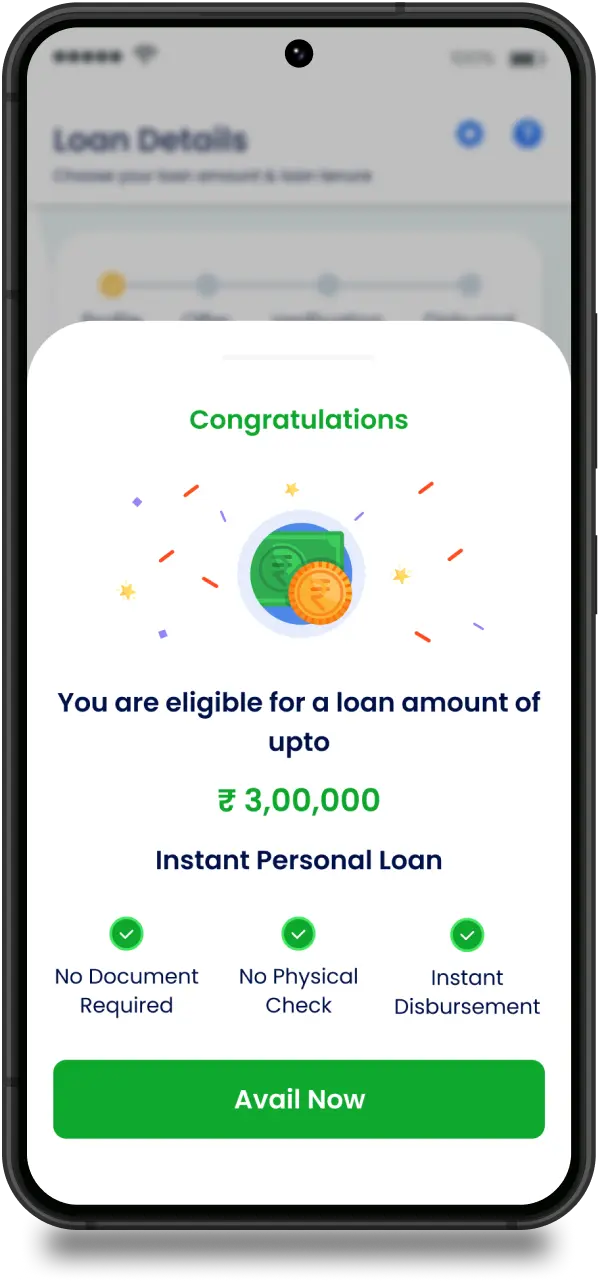

Step 3

Get Quick Approval

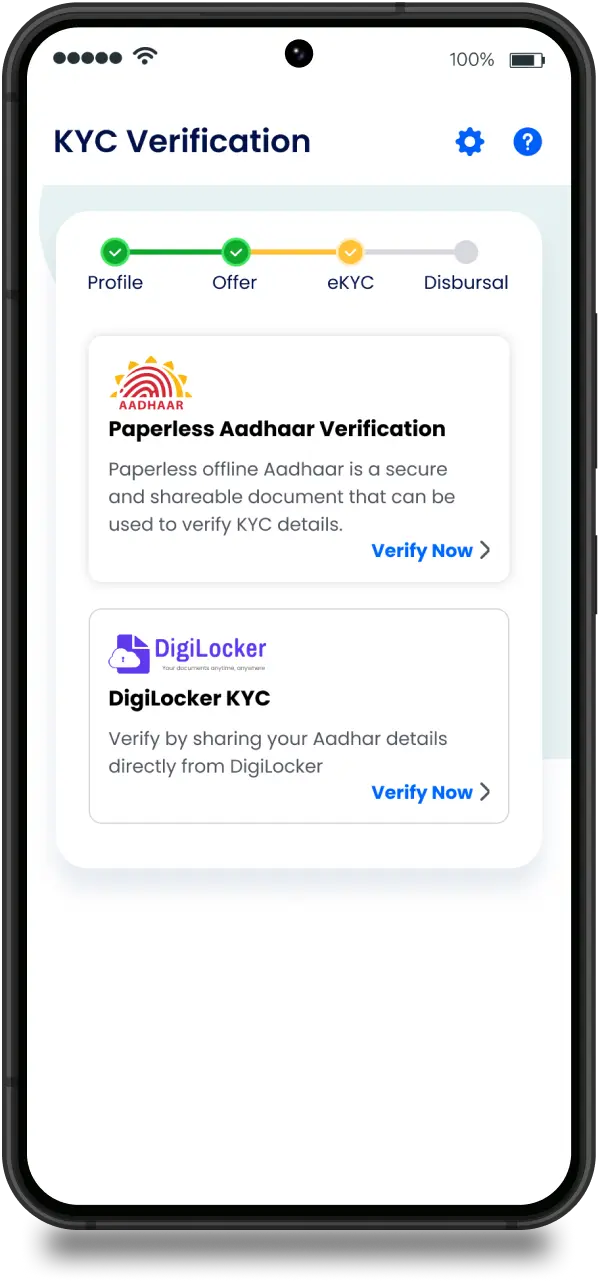

Step 4

Complete e-KYC and verification

Step 5

Get funds in your account

Frequently Asked Questions

How much loan can I get from Aadhaar card?

Using your Aadhaar card, you can get a MoneyGray instant personal loan ranging from ₹ 50,000 to ₹ 25,00,000

Is Aadhaar OTP required for personal loan?

Yes, during the verification process an OTP will be sent to the Aadhaar linked mobile number. You will be required to share the OTP for the completion of your identity verification. Post verification you will be informed if you are eligible to get funds.

What is the process of Aadhaar Verification for a personal loan?

V-KYC is the process through which customers can take the entire verification process through a video call. The verification process using your Aadhaar Card begins with the digital submission of a scanned copy of your Aadhaar Card. After that, a bank official will give you a video call over which he will capture a live photo of the customer and will verify the document regarding Aadhaar number verification and an OTP based verification

What is the interest rate and tenure of Aadhaar card loan?

Interest rate on MoneyGray personal loans on Aadhaar Card is starting from 9% p.a. Also, MoneyGray provides flexible repayment tenure ranging from 3 months to 84 months.

Can I get a personal loan on Aadhaar card without salary slip?

Yes, it is possible to get a personal loan on Aadhaar Card from MoneyGray without a salary slip.